| Ticker | Sector | Value | PE | Yield | Annual Divs | Beta | Weight |

| AAPL | Technology | $2,364.78 | 16.64 | 1.76% | $41.62 | 0.88 | 4.93% |

| BAX | Healthcare | $1,618.47 | 21.89 | 2.97% | $48.07 | 0.71 | 3.37% |

| CHD | Staples | $1,820.96 | 25.92 | 1.71% | $31.14 | 0.46 | 3.79% |

| COP | Energy | $1,649.76 | 10.99 | 4.09% | $67.48 | 1.10 | 3.44% |

| CVX | Energy | $2,741.02 | 11.18 | 3.65% | $100.05 | 1.15 | 5.71% |

| GIS | Staples | $1,978.20 | 19.20 | 3.19% | $63.10 | 0.16 | 4.12% |

| JNJ | Healthcare | $2,920.89 | 17.75 | 2.62% | $76.53 | 0.58 | 6.09% |

| KMB | Staples | $1,146.76 | 20.11 | 2.96% | $33.94 | 0.21 | 2.39% |

| KMI | Energy | $1,762.69 | 33.51 | 4.57% | $80.56 | 0.66 | 3.67% |

| KMR | Energy | $1,156.91 | 61.64 | 5.82% | $67.33 | 0.61 | 2.41% |

| KO | Staples | $1,873.90 | 23.00 | 2.95% | $55.28 | 0.50 | 3.90% |

| MCD | Discretionary | $1,414.04 | 18.35 | 3.64% | $51.47 | 0.37 | 2.95% |

| MO | Staples | $2,249.30 | 21.89 | 4.38% | $98.52 | 0.50 | 4.69% |

| O | REIT | $3,598.23 | 58.89 | 4.73% | $170.20 | 0.53 | 7.50% |

| PEP | Staples | $1,156.95 | 21.16 | 2.74% | $31.70 | 0.41 | 2.41% |

| PG | Staples | $1,667.67 | 24.42 | 2.96% | $49.36 | 0.39 | 3.48% |

| PM | Staples | $2,356.14 | 17.67 | 4.53% | $106.73 | 0.90 | 4.91% |

| ROST | Discretionary | $1,625.80 | 19.62 | 0.99% | $16.10 | 0.61 | 3.39% |

| SBUX | Discretionary | $1,363.32 | 249.42 | 1.35% | $18.40 | 0.89 | 2.84% |

| SO | Utilities | $1,152.50 | 18.51 | 4.52% | $52.09 | 0.17 | 2.40% |

| T | Telecom | $1,180.48 | 10.59 | 5.33% | $62.92 | 0.43 | 2.46% |

| TJX | Discretionary | $1,141.74 | 20.81 | 1.11% | $12.67 | 0.60 | 2.38% |

| UNP | Industrial | $1,276.77 | 22.42 | 1.74% | $22.22 | 1.02 | 2.66% |

| V | Financial | $1,444.38 | 26.95 | 0.68% | $9.82 | 0.81 | 3.01% |

| VZ | Telecom | $1,004.40 | 10.35 | 4.41% | $44.29 | 0.42 | 2.09% |

| WMT | Staples | $847.15 | 15.99 | 2.51% | $21.26 | 0.48 | 1.77% |

| XOM | Energy | $2,780.62 | 12.03 | 2.92% | $81.19 | 0.90 | 5.79% |

| ….. | …..2 | …..3 | …..4 | …..5 | …..6 | …..7 | …..8 |

| Cash | Cash | $693.92 | 1.45% | ||||

| . | .. | Total Sum (with cash) |

… | Avg Yield (no cash) | Annual Divs | Beta Avg | ….. |

| $47,987.74 | 3.20% | $1,514.05 | 0.64 |

Below is a summary of my 401k holdings:

| Ticker | Sector | Market Value | Weight | Yield | Annual Divs |

| VBTIX | Bond Index | $1,139.76 | 8.82% | 2.62% | $29.86 |

| VIIIX | Large Index | $8,955.72 | 69.30% | 1.87% | $167.47 |

| VMCPX | Mid Index | $1,937.20 | 14.99% | 1.14% | $22.08 |

| VSCIX | Small Index | $890.07 | 6.89% | 1.29% | $11.48 |

| . | .. | Total: | … | Avg Yield | Annual Divs |

| $12,922.75 | 1.79% | $230.90 |

Below is a summary of the dividends received in the month of October 2014.

The graph below shows my progress so far. Presently, both my dividends and balance are growing at a rate in line with my predefined goals.

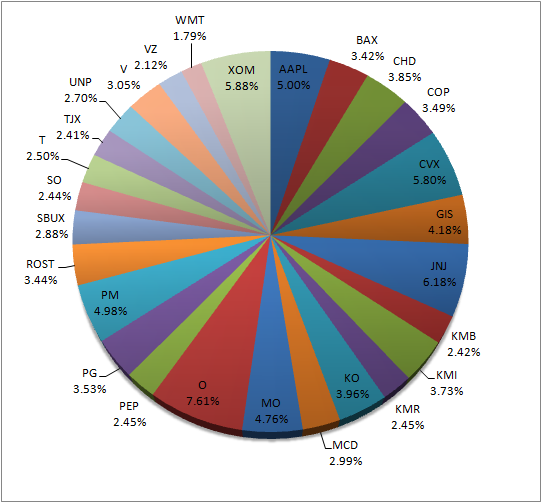

Below is a pie chart showing my current stock weightings in my Roth + Taxable dividends portfolio. I am currently heavily weighted in O, JNJ, the Kinder Morgan stocks, XOM, CVX, and big tobacco.

No comments:

Post a Comment