Friday, November 28, 2014

New buy: KMI

I have purchased 31 shares of KMI. This will add $55 of yearly dividends. I will be sitting on the sidelines for some time for CVX and COP. Recent news from OPEC to not halt production have lowered WTI even further, making many companies involved in oil volatile.

Thursday, November 27, 2014

End of the year goal reached 1 month early!

Due to aggressive saving and rather favorable market conditions, my dividend portfolio has recently passed my end of year 2014 goal of $66,700. As of Thanksgiving day, my portfolio stands at $69,147. Of course the market fluctuations could alter this number. I will continue making contributions in December and this will set my account slightly ahead of schedule which is always good :)

My goal was to yield 3.5% on average, which is around $2300 annually. Unfortunately due to the bull market, there have been less and less dividend stocks that have yields over 3.5%. Most of my stocks lie around the 2.8 to 3.2% range. Part of my portfolio also lies in Vanguard index funds which have yields must less than 3.5%. I am forced to use Vanguard index funds in my 401k because there are no better alternatives available.

My current annual dividend across all my accounts is $1900. This is short by $400. My average yield of dividend stocks and Vanguard indexes is around 2.75%. My dividend portfolio yield is 3.12%.

My current annual dividend across all my accounts is $1900. This is short by $400. My average yield of dividend stocks and Vanguard indexes is around 2.75%. My dividend portfolio yield is 3.12%.

Wednesday, November 26, 2014

Recent buy: HCP

I have added 17 shares of HCP into my Roth IRA to increase my REIT position and to diversify my REITs. I plan to mainly have REITs in my Roth IRA due to tax issues.

I used to have only one REIT holding: O (Realty Income). FAST GRAPHS indicates that shares of HCP are a wee bit above the 15 year PE average. HCP is a steady dividend aristocrat that has paid dividends for 29 years. They have a investment grade BBB+ credit rating.

This will add around $37 of annual income to my portfolio.

I used to have only one REIT holding: O (Realty Income). FAST GRAPHS indicates that shares of HCP are a wee bit above the 15 year PE average. HCP is a steady dividend aristocrat that has paid dividends for 29 years. They have a investment grade BBB+ credit rating.

This will add around $37 of annual income to my portfolio.

Tuesday, November 25, 2014

Recent buy: K

I have added $1100 of Kellogg to my portfolio. I felt this stock was slightly below fair value and offered a strong yield. This will add around 33$ of annual dividends. Kellogg is one of my boring and steady dividend growth stocks. It will help increase my Consumer Staples allocation.

For next week's purchase I am still considering the energy sector, but their prices are still not in my buy range. I have been giving thought to IBM as well since it is starting to get incredibly cheap despite their troubles.

For next week's purchase I am still considering the energy sector, but their prices are still not in my buy range. I have been giving thought to IBM as well since it is starting to get incredibly cheap despite their troubles.

Tuesday, November 18, 2014

Recent buy: KRFT

I bought $1200 worth of KRFT today. The yield is 3.78% and the company and will add $45.36 of annual income. Stocks are expensive now (aside from the energy sector) so I decided to add into a high yielder that wasn't overpriced. I am watching COP and CVX next week for additional purchases since I have a feeling that oil prices will fall further.

Thursday, November 13, 2014

Watchlist update

I've been eyeing the staples sector for possible buys. I am having trouble finding good value in the Industrial sector and am willing to wait. Crude oil has fallen even more and I predict further drop in prices for oil majors. I am going to wait until the oil companies prices fall below what I paid several weeks ago during their lows.

SJM has come up as an interesting pick

SJM has come up as an interesting pick

- 25% debt/cap

- PE bit below historical average

- Strong earnings even during recessions

- Strong dividend history

- Moderately good yield 2.6%

- BBB+ credit rating

GIS also looks good as well.

- 39% debt/cap

- PE a bit higher than average

- Strong earnings even during 2008-2009

- Strong dividend history

- Moderately good yield 3.2%

- BBB+ credit rating

Kellogg is also an interesting play but I feel that the debt is too high at 53%. K is currently below fair value so I think it is a good value pick. SJM has the highest growth of the three.

Monday, November 10, 2014

Recent buy: UTX

I have purchased 11 shares of UTX today in my taxable account. Total cost is around $1200. This will add $26 in dividends annually. I am sad that I missed out on the deal earlier when it dropped below 100. Looking forward to add more if it falls.

Saturday, November 8, 2014

Watchlist: November

I plan to add more to my Industrials this month. The market is expensive right now. These are the deals I think are worth looking at. Refer to the watchlist page for graphs of these stocks: http://youngdiv.blogspot.com/p/watchlist_17.html

UTX

Credit: A

Payout Ratio: 34.8%

Yield: 2.16%

Debt: 32%

Yrs Div Increase: 21!!

LMT

Credit: A-

Payout Ratio: 53.9%

Yield: 3.2%

Debt: 57%

Yrs Div Increase: 12

RTN

Credit: A

Payout Ratio: 36%

Yield: 2.3%

Debt: 28%

Yrs Div Increase: 10

I think Raytheon is a better value from a historical PE perspective and also the debt. I still like the yield of LMT better though. The payout ratio and debt of LMT is a bit high. UTX I believe offers good value at its current price point. The debt is good and the yield is normal for an industrial stock.

In addition to the above industrial stocks, I am thinking of adding small amounts to the following stocks:

HCP

Credit: BBB+

Payout Ratio: ---

Yield: 5.0%

Debt: 45%

Yrs Div Increase: 29!!

TJX

Credit: A+

Payout Ratio: 20.1%

Yield: 1.1%

Debt: 27%

Yrs Div Increase: 18

V

Credit: A+

Payout Ratio: 17.5%

Yield: 0.8%

Debt: 0%

Yrs Div Increase: 7

LOW

Credit: A-

Payout Ratio: 32%

Yield: 1.6%

Debt: 47%

Yrs Div Increase: 52!!

I was very impressed with the dividend increase in V. Even with the huge price rise, I believe this stock has a lot of room to still grow. My last Visa buy was at $201 and I was able to get a really good deal. I think that the price right now is fair value to slightly overvalued. The growth is priced into the stock. Visa has no debt and has a strong business model that everyone uses. The moat is real on this one...

HCP offers me a yield I need and I believe it's fair valued at the moment based off FAST graphs. I am watching LOW and TJX on the sidelines. I might consider adding a bit to TJX. TJX has impressive dividend growth and a proven track record.

UTX

Credit: A

Payout Ratio: 34.8%

Yield: 2.16%

Debt: 32%

Yrs Div Increase: 21!!

LMT

Credit: A-

Payout Ratio: 53.9%

Yield: 3.2%

Debt: 57%

Yrs Div Increase: 12

RTN

Credit: A

Payout Ratio: 36%

Yield: 2.3%

Debt: 28%

Yrs Div Increase: 10

I think Raytheon is a better value from a historical PE perspective and also the debt. I still like the yield of LMT better though. The payout ratio and debt of LMT is a bit high. UTX I believe offers good value at its current price point. The debt is good and the yield is normal for an industrial stock.

In addition to the above industrial stocks, I am thinking of adding small amounts to the following stocks:

HCP

Credit: BBB+

Payout Ratio: ---

Yield: 5.0%

Debt: 45%

Yrs Div Increase: 29!!

TJX

Credit: A+

Payout Ratio: 20.1%

Yield: 1.1%

Debt: 27%

Yrs Div Increase: 18

V

Credit: A+

Payout Ratio: 17.5%

Yield: 0.8%

Debt: 0%

Yrs Div Increase: 7

LOW

Credit: A-

Payout Ratio: 32%

Yield: 1.6%

Debt: 47%

Yrs Div Increase: 52!!

I was very impressed with the dividend increase in V. Even with the huge price rise, I believe this stock has a lot of room to still grow. My last Visa buy was at $201 and I was able to get a really good deal. I think that the price right now is fair value to slightly overvalued. The growth is priced into the stock. Visa has no debt and has a strong business model that everyone uses. The moat is real on this one...

HCP offers me a yield I need and I believe it's fair valued at the moment based off FAST graphs. I am watching LOW and TJX on the sidelines. I might consider adding a bit to TJX. TJX has impressive dividend growth and a proven track record.

Saturday, November 1, 2014

October 2014 Summary

October was a hectic month. The S&P500 plunged from the 1950s to 1860. Many sectors plunged. The energy sector had great losses this month. Surprisingly, the market rose to new highs closing in at 2018. Below is a summary of my Roth + Taxable portfolio standings and the dividends received in October.

| Ticker | Sector | Value | PE | Yield | Annual Divs | Beta | Weight |

| AAPL | Technology | $2,364.78 | 16.64 | 1.76% | $41.62 | 0.88 | 4.93% |

| BAX | Healthcare | $1,618.47 | 21.89 | 2.97% | $48.07 | 0.71 | 3.37% |

| CHD | Staples | $1,820.96 | 25.92 | 1.71% | $31.14 | 0.46 | 3.79% |

| COP | Energy | $1,649.76 | 10.99 | 4.09% | $67.48 | 1.10 | 3.44% |

| CVX | Energy | $2,741.02 | 11.18 | 3.65% | $100.05 | 1.15 | 5.71% |

| GIS | Staples | $1,978.20 | 19.20 | 3.19% | $63.10 | 0.16 | 4.12% |

| JNJ | Healthcare | $2,920.89 | 17.75 | 2.62% | $76.53 | 0.58 | 6.09% |

| KMB | Staples | $1,146.76 | 20.11 | 2.96% | $33.94 | 0.21 | 2.39% |

| KMI | Energy | $1,762.69 | 33.51 | 4.57% | $80.56 | 0.66 | 3.67% |

| KMR | Energy | $1,156.91 | 61.64 | 5.82% | $67.33 | 0.61 | 2.41% |

| KO | Staples | $1,873.90 | 23.00 | 2.95% | $55.28 | 0.50 | 3.90% |

| MCD | Discretionary | $1,414.04 | 18.35 | 3.64% | $51.47 | 0.37 | 2.95% |

| MO | Staples | $2,249.30 | 21.89 | 4.38% | $98.52 | 0.50 | 4.69% |

| O | REIT | $3,598.23 | 58.89 | 4.73% | $170.20 | 0.53 | 7.50% |

| PEP | Staples | $1,156.95 | 21.16 | 2.74% | $31.70 | 0.41 | 2.41% |

| PG | Staples | $1,667.67 | 24.42 | 2.96% | $49.36 | 0.39 | 3.48% |

| PM | Staples | $2,356.14 | 17.67 | 4.53% | $106.73 | 0.90 | 4.91% |

| ROST | Discretionary | $1,625.80 | 19.62 | 0.99% | $16.10 | 0.61 | 3.39% |

| SBUX | Discretionary | $1,363.32 | 249.42 | 1.35% | $18.40 | 0.89 | 2.84% |

| SO | Utilities | $1,152.50 | 18.51 | 4.52% | $52.09 | 0.17 | 2.40% |

| T | Telecom | $1,180.48 | 10.59 | 5.33% | $62.92 | 0.43 | 2.46% |

| TJX | Discretionary | $1,141.74 | 20.81 | 1.11% | $12.67 | 0.60 | 2.38% |

| UNP | Industrial | $1,276.77 | 22.42 | 1.74% | $22.22 | 1.02 | 2.66% |

| V | Financial | $1,444.38 | 26.95 | 0.68% | $9.82 | 0.81 | 3.01% |

| VZ | Telecom | $1,004.40 | 10.35 | 4.41% | $44.29 | 0.42 | 2.09% |

| WMT | Staples | $847.15 | 15.99 | 2.51% | $21.26 | 0.48 | 1.77% |

| XOM | Energy | $2,780.62 | 12.03 | 2.92% | $81.19 | 0.90 | 5.79% |

| ….. | …..2 | …..3 | …..4 | …..5 | …..6 | …..7 | …..8 |

| Cash | Cash | $693.92 | 1.45% | ||||

| . | .. | Total Sum (with cash) |

… | Avg Yield (no cash) | Annual Divs | Beta Avg | ….. |

| $47,987.74 | 3.20% | $1,514.05 | 0.64 |

Below is a summary of my 401k holdings:

| Ticker | Sector | Market Value | Weight | Yield | Annual Divs |

| VBTIX | Bond Index | $1,139.76 | 8.82% | 2.62% | $29.86 |

| VIIIX | Large Index | $8,955.72 | 69.30% | 1.87% | $167.47 |

| VMCPX | Mid Index | $1,937.20 | 14.99% | 1.14% | $22.08 |

| VSCIX | Small Index | $890.07 | 6.89% | 1.29% | $11.48 |

| . | .. | Total: | … | Avg Yield | Annual Divs |

| $12,922.75 | 1.79% | $230.90 |

Below is a summary of the dividends received in the month of October 2014.

The graph below shows my progress so far. Presently, both my dividends and balance are growing at a rate in line with my predefined goals.

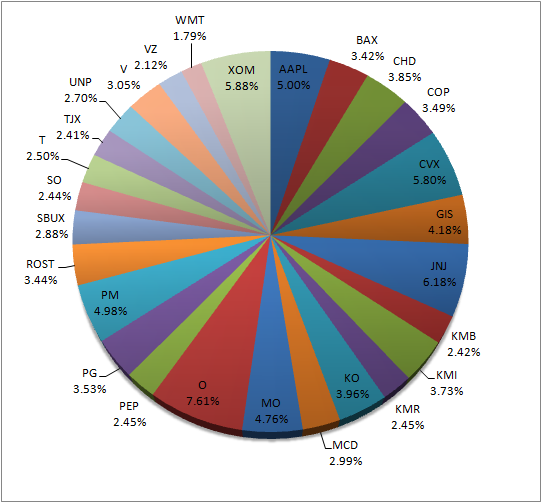

Below is a pie chart showing my current stock weightings in my Roth + Taxable dividends portfolio. I am currently heavily weighted in O, JNJ, the Kinder Morgan stocks, XOM, CVX, and big tobacco.

Planning my monthly dividends

Since I am a picky planner, I prefer having consistently increasing dividends month after month. My current dividend picks favor more dividend payers in Mar/Jun/Sept/Dec months. My Jan/Apr/July/Oct months are the weakest. Even though I have a preference in picking stocks that will even out my distributions every month, I will still prioritize good deals over preferred planning (such as the very low price of CVX and XOM in the last couple of weeks).

Currently with my present portfolio holdings, I am on my way to receiving the following dividends in November and December of this year (these stocks deposit their dividends checks to me on the following months):

The growth of the Nov & Dec dividends per month are in line with my goals. However, when January and February of next year comes, my dividends with my current holdings is estimated to be:

Note that how February is essentially the same as November and January is similar to October (not shown). This is because these months are paid by the same companies (with a few irregulars who pay at weird dates). The graph below summarizes this data:

Currently with my present portfolio holdings, I am on my way to receiving the following dividends in November and December of this year (these stocks deposit their dividends checks to me on the following months):

| November | … | ,,, | December | …. |

| AAPL | $10.41 | CHD | $7.78 | |

| GIS | $15.78 | COP | $16.87 | |

| KMI | $20.14 | CVX | $25.01 | |

| KMR | $16.83 | JNJ | $19.13 | |

| O | $14.18 | KO | $13.82 | |

| PG | $12.34 | MCD | $12.87 | |

| T | $15.73 | O | $14.18 | |

| VZ | $11.07 | ROST | $4.02 | |

| SBUX | $4.60 | TJX | $3.17 | |

| V | $2.46 | |||

| XOM | $20.30 | |||

| SO | $13.02 | |||

| $121.08 | $152.64 |

The growth of the Nov & Dec dividends per month are in line with my goals. However, when January and February of next year comes, my dividends with my current holdings is estimated to be:

| January | . | ,.. | February | .. |

| KMB | $8.49 | AAPL | $10.41 | |

| MO | $24.63 | GIS | $15.78 | |

| O | $14.18 | KMI | $20.14 | |

| PEP | $7.93 | KMR | $16.83 | |

| PM | $26.68 | O | $14.18 | |

| WMT | $5.32 | PG | $12.34 | |

| BAX | $12.02 | T | $15.73 | |

| UNP | $5.55 | VZ | $11.07 | |

| SBUX | $4.60 | |||

| $104.79 | $121.08 |

Note that how February is essentially the same as November and January is similar to October (not shown). This is because these months are paid by the same companies (with a few irregulars who pay at weird dates). The graph below summarizes this data:

The green bars represent the forecast and the blue are the ones already received. The Nov & Dec guidance appear in line; however, the Jan forecast is lagging. February is not shown since it's essentially the same as October.

My December holding is very heavy in oil and I do not plan to add anymore to oil unless there is an extreme drop since I have already added quite a bit into XOM and CVX. The following stocks that will pay dividends in January are shown below (the first couple I already own):

| KMB | KO | MO | O | PM | BAX | UNP | ITW |

| ADP | BNS | BF_B | CB | DEO | DOW | FDO | GE |

| GPC | GSK | KRFT | MKC | MDT | MRK | NKE | OXY |

| PNY | RAI | SLB | TROW | TD | USB | XEL | SYY |

Presently my Oct/Jan month is heavily tobacco. I prefer avoiding the financial sector which are stocks such as BNS and TD. For the month of January I am eyeing ITW, KMB, RAI, MKC, PNY, and KRFT. I have already recently added to KO. With my recent purchases in low yield growth stocks, I need companies that have higher yields. RAI, KMB, PNY & KRFT fit the requirements. However most of these appear expensive aside from KRFT at the moment so I am willing to wait. This purchase doesn't have to be made until the ex-dividend dates which are in early-mid December.

For divs in February, the following list of stocks are on my watchlist, the first couple are ones that I own:

| AAPL | GIS | KMI | KMR | O | PG | T | VZ | SBUX |

| ABT | ABBV | APD | CAT | CLX | DE | DEO | HCP | HCN |

| HRL | NUE | OHI | YUM |

I am presently eyeing HCP, PG, GIS, and YUM. To satisfy my preference for high yield, I believe the order of priority will be HCP > GIS > PG. Of the three, I believe GIS has the best value. PG looks overpriced. T, VZ, HCN, OHI, KMI/KMR, and CLX are attractive secondary options. I do not want to load anymore in telecom (T/VZ). For REIT I will take HCP over HCN and OHI due to HCP being the dividend champion. I do not want to overload my position any further in the Kinder family (KMI/KMR). And CLX has too much debt. The following stocks above have to be purchased before their ex-dividend date which is usually some time in early to mid January.

Subscribe to:

Posts (Atom)